Contents [show]

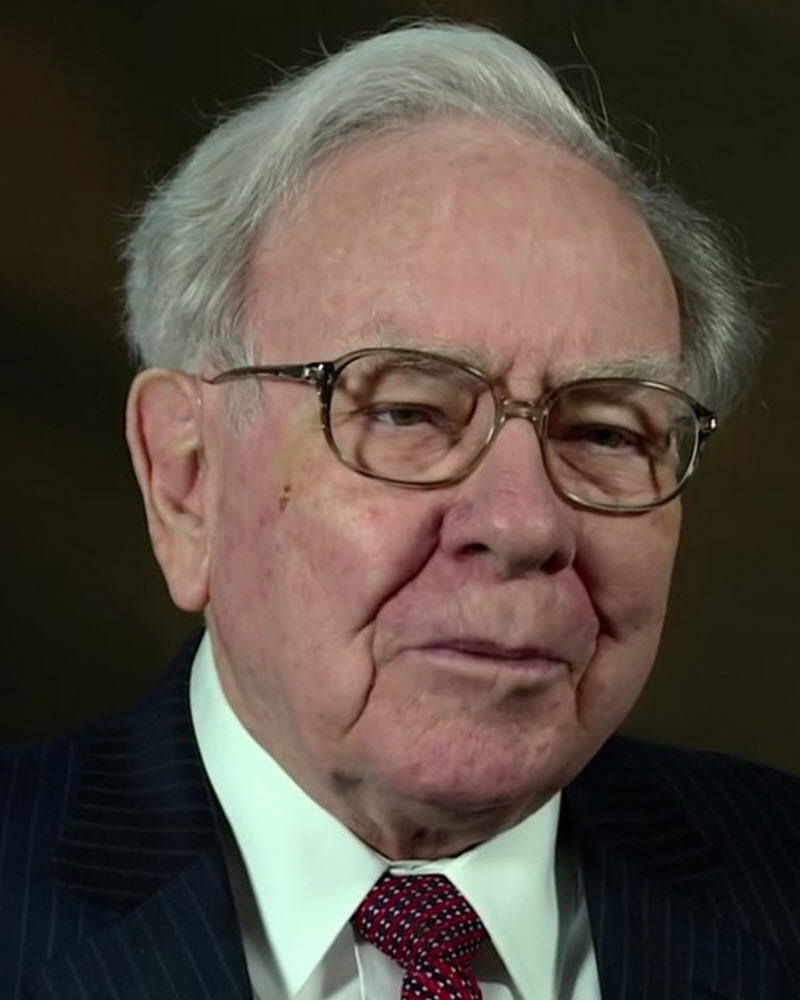

Heralded as one of the most influential investors of the modern era, Warren Buffett is synonymous with economic success and financial wizardry. Few individuals can boast successes that echo beyond the confines of their industry, but Mr. Buffett is certainly one such person. Let’s delve into the life and immense achievments of Warren Buffet.

Early Life

Warren Edward Buffet was born on August 30, 1930, in Omaha, Nebraska. His parents were Leila (née Stahl) and Howard Buffett. Warren had two sisters; one older and one younger.

Warren demonstrated a natural knack for business from a young age. He sold chewing gum, Coca-Cola and weekly magazines door to door, and worked in his grandfather’s grocery store.

The family moved from Omaha to Washington, D.C. in 1942 when Howard Buffett was elected to the United States Congress. Warren graduated from Woodrow Wilson High School in 1947 and his senior yearbook picture read “likes math; a future stockbroker”. While still in high school, Warren was made money in various ways including selling golf balls and stamps, delivering newspapers, and detailing cars. On his very first income tax return, in 1944, Warren deducted $35 for the use of his bicycle and watch while delivering papers.

A notable example of Warren’s entrepreneurial spirit is from 1945, when he and a friend purchased a used pinball machine for $25 and placed it in a local barber shop. Within months, their empire had expanded to include several machines in three different barber shops. Eventually, the whole business was purchased by a war veteran for $1,200.

Warren wanted to go into the world of business directly after high school, but his father pushed for a college education, and Warren enrolled in the the Wharton School at the University of Pennsylvania when he was 16. After two years, he transferred to the University of Nebraska, where he graduated at age 20.

A Meeting with Benjamin Graham

An important moment in Warren Buffet’s life was when he attended a lecture by Benjamin Graham, a renowned figure in the finance world, whose book “The Intelligent Investor” was foundational to Buffett’s investment philosophy. This encounter led to Buffett enrolling at Columbia Business School, where he further developed his understanding of investing under the tutelage of Graham.

Berkshire Hathaway Acquisition

When Graham retired, Buffett set his sights on a textile company named Berkshire Hathaway. Starting with substantial stock investments in 1962, by 1965 Warren had taken complete control of the company. The U.S. textile industry was not doing well, but Buffett converted Berkshire into a holdings institution, hiding his future investments under its shelter.

Warren’s Investment Philosophy

Buffett’s investment philosophy is often characterized by his avowed principle of value investing, which involves picking stocks that appear to be undervalued by the market. The hallmark of his approach is an exhaustive review of a company’s financial health and the intrinsic value of its stock. Buffett’s famous quote, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” underlines his business acumen.

Buffet in the 21st century

Instead of retiring full time, Buffet continued to enhance Berkshire Hathaway’s investment portfolio, particularly in the energy sector, with significant investments in Occidental Petroleum. Berkshire Hathaway increased its stake in Occidental Petroleum by purchasing an additional 10.5 million shares, totaling about $589 million, in a move that brought Berkshire’s total stake in Occidental to 27.2%, alongside holding an additional $8.5 billion in preferred shares and warrants. The decision to augment investments in Occidental Petroleum, an energy company, appears to stem from a strategic shift towards companies with solid positions in resource-rich areas, notably the Permian basin, and those capable of generating substantial free cash flow amidst fluctuating oil prices.

Moreover, Buffett’s penchant for buybacks of Berkshire Hathaway’s own stock remains unwavering. Since July 2018, when the company amended its buyback rules, Berkshire Hathaway has repurchased more than $74 billion of its stock, a clear testament to Buffett’s confidence in the intrinsic value of his company. The buybacks underscore a strategic initiative to enhance shareholder value, demonstrating Buffett’s belief in the long-term prospects of Berkshire Hathaway. This approach not only reflects Buffett’s investment acumen but also his commitment to capital allocation strategies that prioritize long-term growth over short-term gains.

Buffett’s activities, including the continued investment in Occidental Petroleum and the strategic buybacks of Berkshire Hathaway shares, signify a calculated approach to navigating the current economic landscape. By focusing on companies with strong fundamentals and potential for robust cash flow, such as Occidental, and simultaneously enhancing shareholder value through stock repurchases, Buffett is positioning Berkshire Hathaway for sustained growth and stability.

Philanthropy

Apart from his brilliance in making money, Buffett is appreciated for his commitment to giving back to society. In 2006, he pledged to give away 85% of his Berkshire stocks to five foundations, the most significant share going to the Bill and Melinda Gates Foundation. This act positioned him as one of the most magnanimous donors globally.

Buffett has expressed concerns about unchecked population growth, and in 2009, he met with the so called “Good Club” to discuss healthcare, education and slowing population growth. The Good Club, comprised by billionaires, have so far donated $45 billion to philanthropic causes. Buffet’s negative attutitudes towards unchecked population growth has drawn criticism from some right-wing activist groups.

Buffet has also been both hailed and critized for his support of family planning, including abortions. Through the Buffet Foundation, he has given over $1.5 billion to abortion research, including over $425 million to Planned Parenthood.

Personal Life

Marriage

Buffett married Susan Buffett (born Thompson) in 1952, at the Dundee Presbyterian Church in Omaha. Just like him, she was from Omaha, where she was born in 1932. Her father had been a one-time campaign manager for Howard Buffett, but even though their parents knew each other, Warren and Susan did not meet each other until later, when Warren´s sister Roberta Buffet became Susan’s roomate at Northwestern University.

Susan and Warren had three children together:

- Susan (Susie), born July 30, 1953

- Howard, born December 16, 1954

- Peter, born May 4, 1958

The couple began living separately in 1977, but did not divorce, and they remained married until Susan Buffet’s death in 2004. In 1978, Susan introduced Warren to Astrid Menks. The three were often seen together as a trio and even sent out joint Christmas cards signed Warren, Susan, and Astrid. After Susan´s death, Warren and Astrid married.

Homes

The Buffet family bought a house in the central Dundee neighborhood of Omaha for $31,000 in 1958, and this is still his primary residence.

In 1971, they purchased a vacation home in Laguna Beach, California, for $150,000. This home was kept until 2018, when it sold for $7.5 million.

Jetting

In 1989, almost $6.7 million of Berkshire’s funds were spent on a private jet, an act that went against Buffet’s previous criticism of extravagant purchases for CEO use. Buffet originally called it “The Indefensible”, but would later rename it “The Indispensable”. The jet was sold prior to mid-1999, after which Buffet began using Berkshire’s flight services business instead.

Playing the ukulele

In 1949, Buffett bought a ukulele and learned how to play it, since he had a crush on a woman whose boyfriend played the instrument. He did not manage to win her affections, but it did turn him into a life-long ukulele player. Buffett is known of play the ukulele at stockholder meetings and other gatherings. He has commissioned two custom Dairy Queen ukuleles from Dave Talsma; one of which was auctioned off for charity.

Buffet´s interest in music was also a key in him becoming involved with Susan Thompson, the woman he would eventually marry.

Playing bridge

Buffet is a devoted bridge player and is said to play for many hours each week. He has played a lot with notable names such as Bill Gates and the champion player Sharon Osberg.

The Buffet Cup is a biennial bridge competition sponsored by Buffet and modelled on the Ryder Cup. It was held for the first time in 2006. Teams are selected by invitation, and each team must contain at leaste two women. In 2019, a Chinese team was invited for the first time.

Football

Buffet is a lifelong fan of The Nebraska Cornhuskers football team.

Religion

Buffet was raised as a Presbyterian but has since described himself as agnostic.

Jimmy Buffet

Warren Buffet was a long-time friend of the singer-songwriter Jimmy Buffett, until Jimmy’s death in 2023, and they would refer to each other as “Uncle Warren” and “Cousin Jimmy”.

Warren Buffett’s Legacy

There are not many investors that has influenced the investment world as significantly as Warren Buffett. Dubbed the ‘Oracle of Omaha,’ his success story transcends borders and continues to inspire an entire generation of young entrepreneurs and investors. His principles of value investing and his astute business sense serve as the perfect blueprint for those wishing to make their mark in the field of investing.

To conclude, Warren Buffett’s infallible financial acumen, the ability to make shrewd business decisions, and his magnanimity make him a towering figure in the world of finance and philanthropy. His life—personal and professional—offers vital lessons in resilience, patience, generosity, and, above all, an unwavering belief in one’s abilities. Buffett’s journey is a testament to how business’s magic lies in simplicity, persistence, and the ability to spot value where others see none.